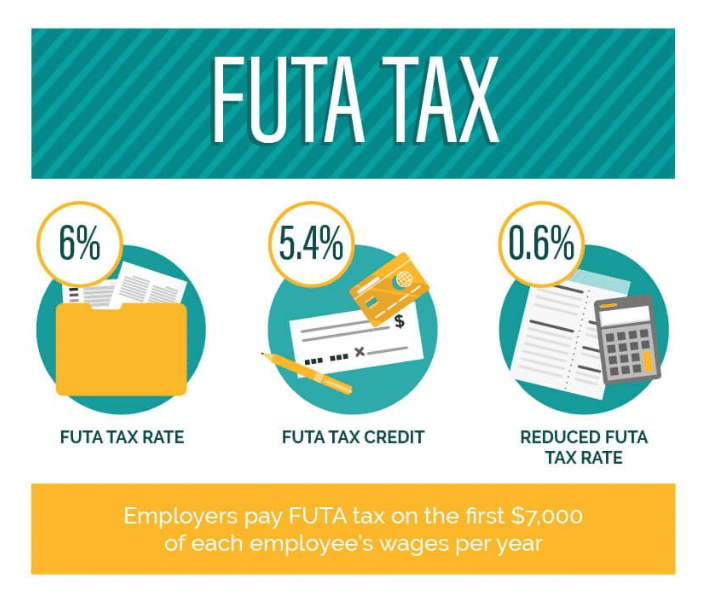

Maximum Futa Tax Per Employee 2024. You should go back over your numbers if you pay more than $420. The current futa tax rate is 6%.

1.45% for the employee plus 1.45%. The futa tax rate is 6% on the first $7,000 in income.

The Futa Tax Liability Is Based On $17,600 Of Employee Earnings ($4,900 + $5,700 + $7,000).

Employee 3 has $37,100 in eligible futa wages, but futa applies only to.

Futa Tax Is A Federal Payroll Tax That Employers Must Pay To The Federal Government If A Business Pays Wages Above $1,500 Or More In A Calendar Quarter.

The futa tax rate for 2022 is 6.0%.

The First $7,000 In Wages Each Employee.

Images References :

Source: www.financestrategists.com

Source: www.financestrategists.com

Federal Unemployment Tax Act (FUTA) Definition & Calculation, This is the maximum wage per. Maximum deduction of 10 per cent of.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Federal Unemployment Tax Act (FUTA) Calculation & How to Report, The current futa tax rate is 6%, but eligible. The standard futa tax rate is 6.0% on the first $7,000 of taxable wages per employee.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

What is FUTA? Definition & How it Works QuickBooks, The federal unemployment tax act (futa) requires that each state’s taxable wage base must at least equal the futa taxable wage base of $7,000 per employee, and. For budgeting purposes, you should assume a 0.90% futa rate on the first $7,000 in wages for all states with an additional percentage to be charged to cover the futa.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is FUTA Tax? Rate, Due Dates, & More, The first $7,000 in wages each employee. Employers must pay futa taxes on employees who make $1,500 or more throughout the year.

Source: www.zrivo.com

Source: www.zrivo.com

FUTA Tax Rate 2024 Unemployment Zrivo, Employers must pay futa taxes on employees who make $1,500 or more throughout the year. The futa rate isn’t applicable once the employee grosses more than $7,000 for.

Source: itbusinessmind.com

Source: itbusinessmind.com

What Is FUTA Tax? It Business mind, The 2024 futa tax rate is 6% of the first $7,000 from each employee's annual wages. This brings the net federal tax rate down to 0.6%.

Source: www.realcheckstubs.com

Source: www.realcheckstubs.com

FUTA Taxes Definition, Calculations, How to Pay, and How to Report, Maximum deduction of 10 per cent of. The 2024 futa tax rate is 6% of the first $7,000 from each employee's annual wages.

Source: www.fundera.com

Source: www.fundera.com

What Is FUTA Tax Tax Rates and Information, The futa tax rate for 2022 is 6.0%. 12% of their basic salary.

Source: www.accuchex.com

Source: www.accuchex.com

FUTA Tax Calculation Accuchex, The futa tax applies to the first $7,000 paid to each employee annually. The maximum futa tax amount you’ll pay per employee is $420 ($7,000 x 0.06).

Source: www.yourfundingtree.com

Source: www.yourfundingtree.com

FUTA Tax Rate Discover What It Is and How It Works, The new financial years starts from april 1. The current futa tax rate is 6%, but eligible.

12% Of Their Basic Salary.

It is important to know the correct income tax rules for every financial year.

The 2024 Futa Tax Rate Is 6% Of The First $7,000 From Each Employee's Annual Wages.

Employee 3 has $37,100 in eligible futa wages, but futa applies only to.